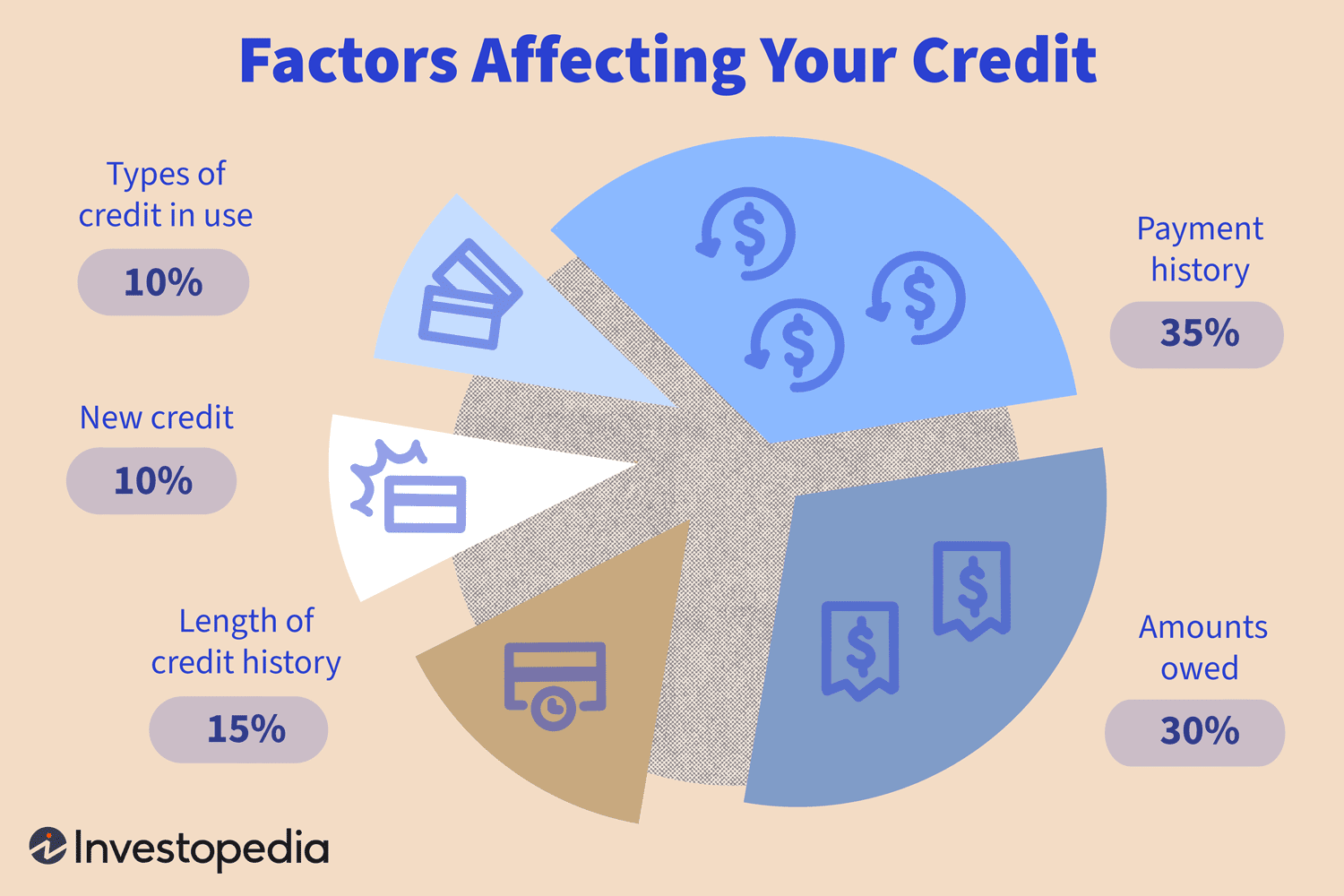

A credit score is a three-digit number that measures a person’s creditworthiness. It is calculated based on information in a credit report at the time of application for a loan or credit card. A credit report includes your credit history, which includes information such as your payment history and the amount you owe. The credit report also includes any loans or credit cards you have and a list of contacts you have provided.

Your credit score is based on the information in your credit report. It is calculated using a scorecard that uses different factors to determine your creditworthiness. For example, your ability to manage your debt is determined by the amount of debt you have, how long you have been using credit, and whether you have had your credit cards for a long period.

Do you need a cosigner for a bad credit loan?

So you’ve applied for a loan and found out that you have bad credit. The good news is that you have options. Click here to read if you’re looking for a loan, consider applying for a loan from an independent lender. These lenders often have lower traditional underwriting standards, which makes them more forgiving of bad credit.

You also have the option of applying for a cosigned loan, which is a loan that is co-signed by someone with good credit. A cosigner can help you get a loan, but it isn’t free. The cosigner will be responsible for the loan if you default on repayment. The best option is to improve your credit score. Improve your credit so that you can apply for a loan on your own in the future.

For example, if your co-signer’s credit is not good enough, you may not be able to get approved for a bad credit loan at all. However, if the cosigner does qualify, you will be responsible for paying back the loan, even if your cosigner does not pay back the loan.

What is the average bad credit score for approval?

The easiest way to boost your credit score is to pay off your past debts on time. To ensure that you always pay off your debts on time, you should be careful when borrowing money. The first thing that you should do when you plan to borrow money is to calculate your monthly income.

Then, you can calculate how much to pay off your debts and how much to save. If you need to borrow money, you should borrow only a small amount. If you borrow a large sum of money, you will have to pay a large amount of interest. To ensure that you can repay the loan, you should ensure that you will be able to pay off the loan on time.